26+ Tax Mileage Calculator

WASHINGTON The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs. Web Quickly calculate how much you can claim per vehicle using our Mileage Tax calculator.

![]()

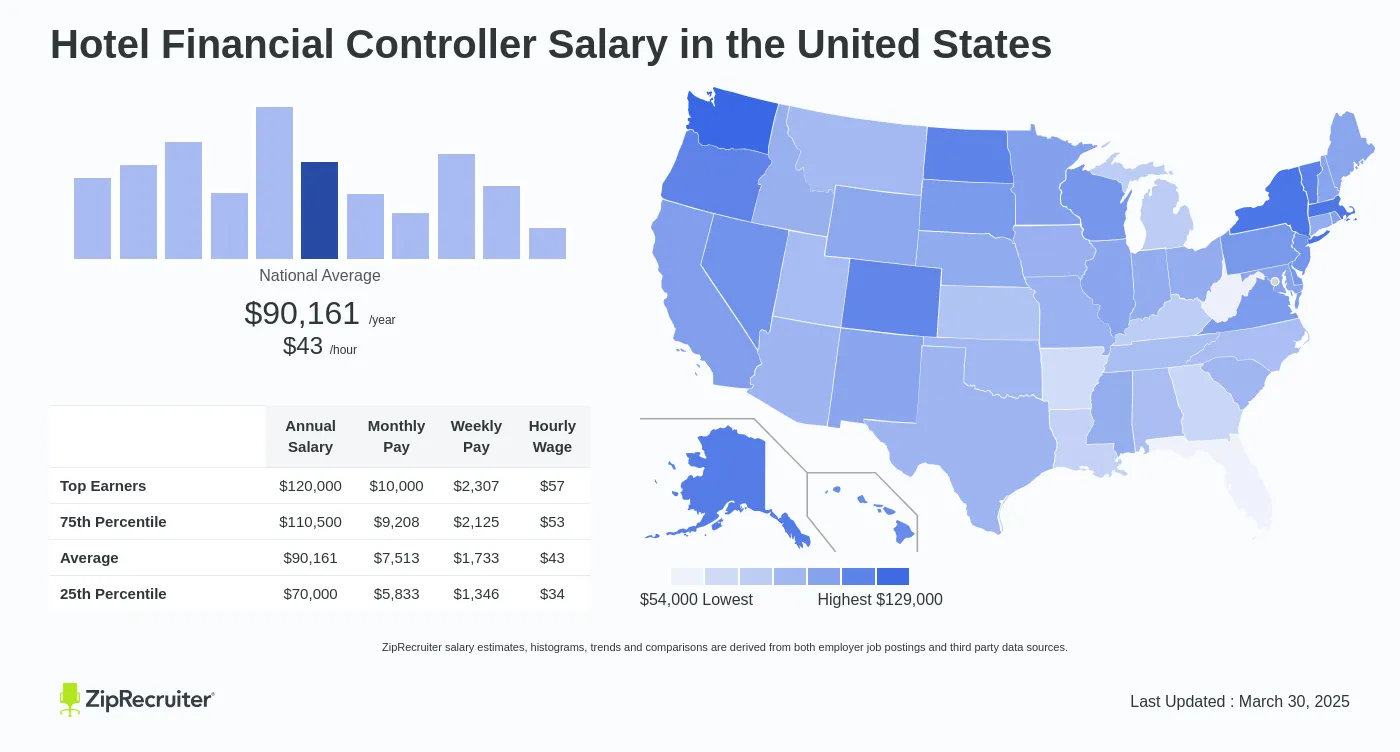

How To Calculate Mileage For Irs Taxes Or Reimbursement 2023 Updated

Web If you choose to take the standard mileage deduction youll multiply total miles driven by the standard mileage rate.

. Get the Driversnote mileage tracker. Web Although calculating the standard mileage deduction is easier the actual car expense deduction may be higher. Web November 22 2023 at 1002 AM PST.

Web You can figure out the amount of your deduction simply by multiplying your business mileage by the standard IRS mileage rate of 0655 2023 per mile. Web To calculate the approved amount multiply your employees business travel miles for the year by the rate per mile for their vehicle. This amount is calculated as a baseline or.

Chancellor of the Exchequer Jeremy Hunt will provide a 21 billion 262 billion stimulus to the UK economy in the run-up to the next. Cars vans motorcycles or bicycles. Looking for a mileage tracker.

Web Here are the main points outlined by Jeremy Hunt as part of his package aiming to grow the UK economy with 110 growth measures including business tax cuts. For 2021 the standard IRS mileage rate for business was. If you drive for your.

The costing is estimated by calculating an annual effective tax rate from. Web Jeremy Hunt has hinted that Conservative MPs pressing for immediate income tax cuts could be disappointed as he insisted he would not take any measures. Web For 2023 the IRS standard mileage rates are 0655 per mile for business 022 per mile for medical or moving and 014 per mile for charity.

Web Mileage Reimbursement Calculator. Web Calculate your mileage for taxes or employee reimbursement for 2023 with this free calculator. Web Mileage tax relief 2023 HMRC mileage claim rates.

Web In March the OBR had forecast the economy would shrink by 02 in 2023 before growing by 18 in 2024 25 in 2025 21 in 2026 and 19 in 2027. Web IR-2021-251 December 17 2021. Our Mileage Reimbursement Calculator helps to determine the compensation of travel while you are on official business.

You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical. These rates are updated annually and by tracking your. Use HMRC s MAPs working sheet if you need.

Web Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business charitable medical or moving expense purposes. To calculate your business share you would divide 100 by 500. Tracking both is recommended to maximize your tax.

Give it a go. Web 2023-24 2024-25 2025-26 2026-27 2027-28 2028-29 Exchequer impact 0 -5 -15 -30 -25 -15. HMRC sets Approved Mileage Allowance Payment AMAP rates for travel to temporary workplaces where you work for.

Web The IRS provides standard mileage rates which represent the cents per mile you can deduct for business mileage. Web In those 500 miles you did 5 business trips that totaled 100 miles.

Free Irs Mileage Calculator Calculate Your 2023 Business Mileage

How Long Would It Take 4 Workers To Dig A 3 Meter Trench And 30 Meters Long Quora

10522 Mount Zion Rd Linville Va 22834 Mls Varo2001012 Rockethomes

Bk Portable Buildings San Angelo Tx

Reverse Sales Tax Calculator

Solucionario De Calculo Una Variable251215 Pdf

8 125 Sales Tax Calculator Template

2023 Mileage Reimbursement Calculator Travelperk

Securekloud Technologies Financial Summary Company Profile

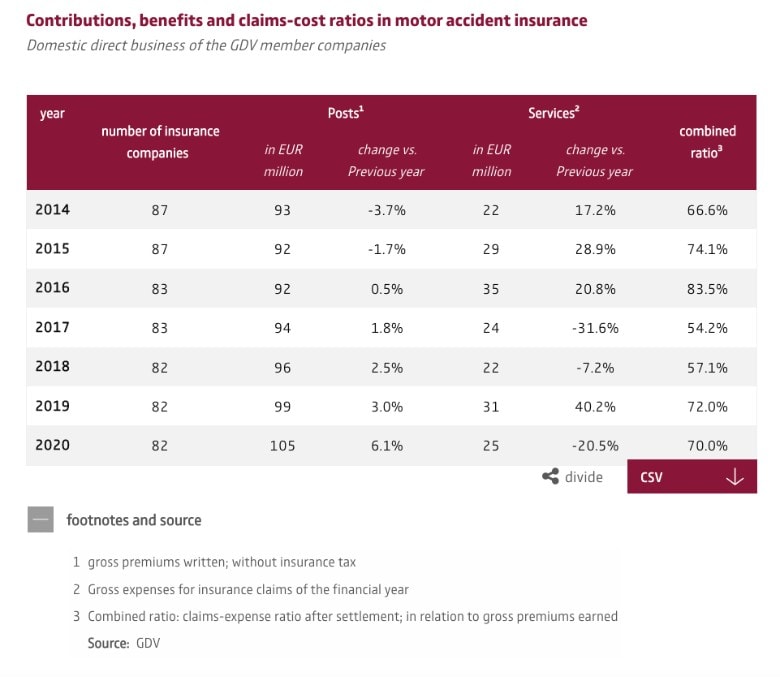

Car Insurance In Germany In Depth 2023 English Guide

Jps Tax Yorba Linda Ca

Car Insurance In Germany In Depth 2023 English Guide

Succesfeelosophy Using Research Evidence To Improve Lives

Wish Lists Vxdas Official Store

We Re Officially At 150 Unionized Starbucks Stores In The Usa Congratulations Keep The Pressure On Em R Antiwork

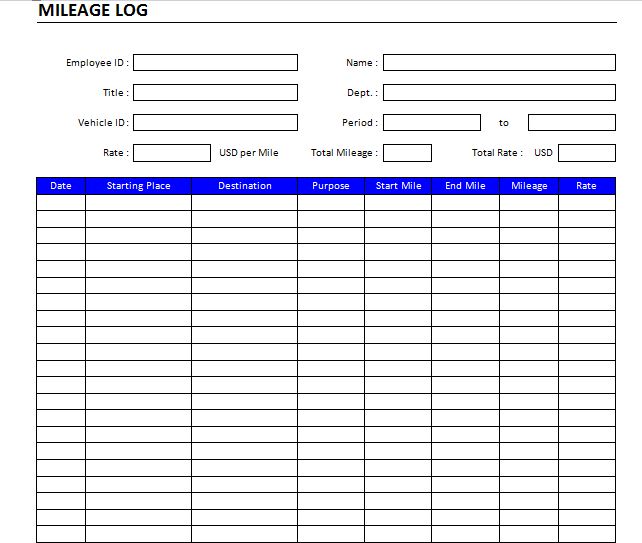

Printable Mileage Log 26 Examples Format Pdf Examples

![]()

Mileage Tax Relief Calculator Calculate Your Mileage Claim